EDITOR'S NOTE

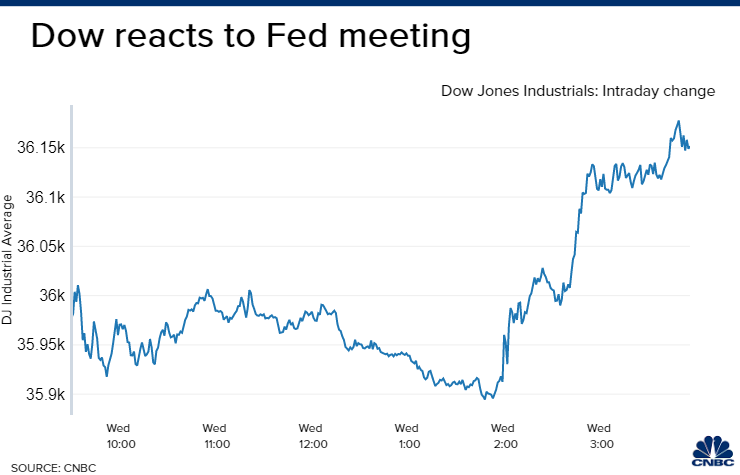

U.S. stocks closed at record levels on Wednesday following the highly anticipated Federal Reserve meeting. The Dow Jones Industrial Average earned back a 160-point loss to close more than 100 points higher. The small-cap benchmark Russell 2000 also closed at a record on Wednesday. The average is up 4.6% this week.

The central bank, as expected, announced it will begin tapering its bond-buying program later this month — $15 billion at a time. This signaled the Fed believes the economy is strong enough to remove stimulus. In its statement, the central bank also said it is prepared to alter the pace of purchases if warranted by changes in the economic outlook.

During his post-meeting news conference on Wednesday afternoon, Fed Chair Jerome Powell noted that there's further ground to cover before the economy reaches maximum employment and thus it's not yet time to raise interest rates.

"Our decision today to begin tapering our asset purchases does not imply any direct signal regarding our interest rate policy. We continue to articulate a different and more stringent test for the economic conditions that would need to be met before raising the federal funds rate," Powell said.

"I think what they're trying to do is draw space between when they're done with tapering (and) when they start tightening because they've always tried to say these are two distinct things," said David Kelly, chief global strategist of J.P. Morgan Asset Management.

"I think this means that they're going to wait until the last meeting of 2022, just like they did in the last decade... to actually put in rate hikes," he said.  Meanwhile, with the personal consumption expenditures price index running above 4%, Peter Boockvar of Bleakley Advisory Group said the Fed is "sticking to their symmetry goals to the detriment of businesses and consumers."

"There remains quite a disconnect between the reality that I see and what I believe most Americans are experiencing, both households and businesses and what the Fed sees to the point that it seems like the September FOMC statement was not updated for today," said Boockvar.

TOP NEWS

TOP VIDEO

CNBC PRO

SPECIAL REPORTS

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Rabu, 03 November 2021

Stocks close at new highs | Fed to begin curtailing bond purchases | How to play the taper

Langganan:

Posting Komentar (Atom)

Tidak ada komentar:

Posting Komentar