EDITOR'S NOTE

There may have been a time, not too long ago, when stock prices could ride on promises, but that time has passed.

The ride-hailing company on Tuesday promised "total company EBITDA profitability for the full year 2021." But when analysts asked executives how they would achieve that goal, they got few details.

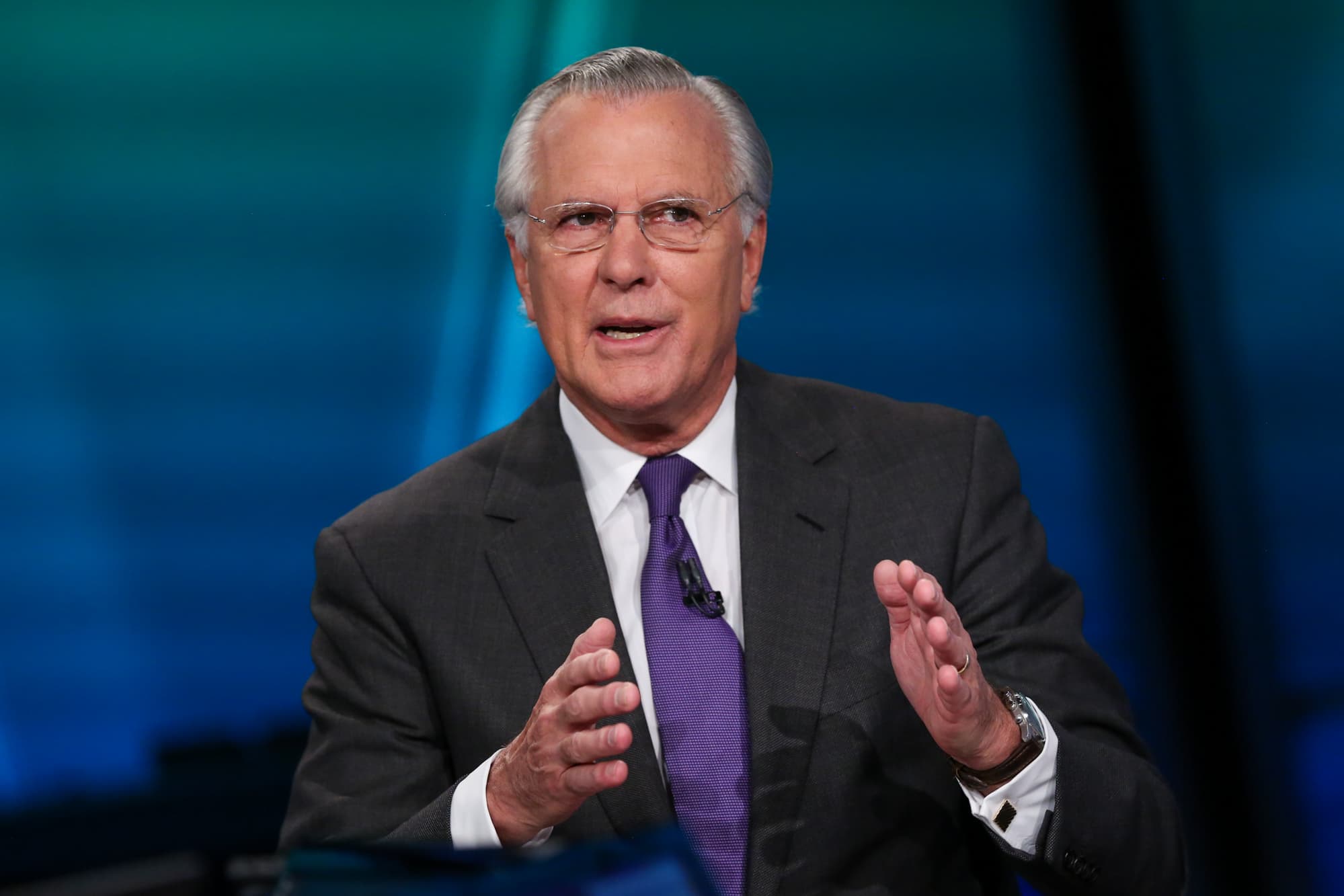

The market may be at record highs but it is no longer taking promises, as long evidenced by WeWork. J.P. Morgan Chase CEO Jamie Dimon told CNBC on Tuesday that he learned a few lessons while advising the troubled office space-sharing company, which dashed plans for an initial public stock offering in September because it couldn't offer more than a promise of profitability.

WeWork should have had better corporate governance, Dimon said. "There are a lot of lessons to be learned on the way by everybody involved," he said, "and I've learned a few myself."

Robinhood, which has disrupted the brokerage industry with its no-fee trades, is learning a lesson, too.

Some of its users found a way to borrow whatever they wanted for margin trades by manipulating the app, CNBC's Kate Rooney writes. One user boasted that he took a $1 million stock position with just a $4,000 deposit. It was called "infinite leverage" on Reddit.

How's that for a promise?

Navigating the world of financial products such as credit cards can be confusing. That's why we launched CNBC Select where we simplify the process by crunching the numbers, reviewing dozens of offers and providing you with all the information you need in one place. Click here to learn more. TOP NEWS

TOP VIDEO

CNBC PRO

SPECIAL REPORTS

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Selasa, 05 November 2019

Another Dow record | Dimon learns a lesson | Buying with 'infinite leverage'?

Langganan:

Posting Komentar (Atom)

Tidak ada komentar:

Posting Komentar