Stocks crept higher on Wednesday.

| WED, DEC 08, 2021 | | | | DOW | | NAME | LAST | CHG | %CHG | | AAPL | 175.08 | +3.90 | +2.28% | | INTC | 51.75 | -0.82 | -1.56% | | MSFT | 334.97 | +0.05 | +0.01% | |

| | S&P 500 | | NAME | LAST | CHG | %CHG | | AAPL | 175.08 | +3.90 | +2.28% | | CCL | 19.52 | +1.02 | +5.51% | | F | 19.81 | -0.15 | -0.75% | |

| | NASDAQ | | NAME | LAST | CHG | %CHG | | AAPL | 175.08 | +3.90 | +2.28% | | NVDA | 318.26 | -6.01 | -1.85% | | AMD | 145.24 | +0.39 | +0.27% | |

| |

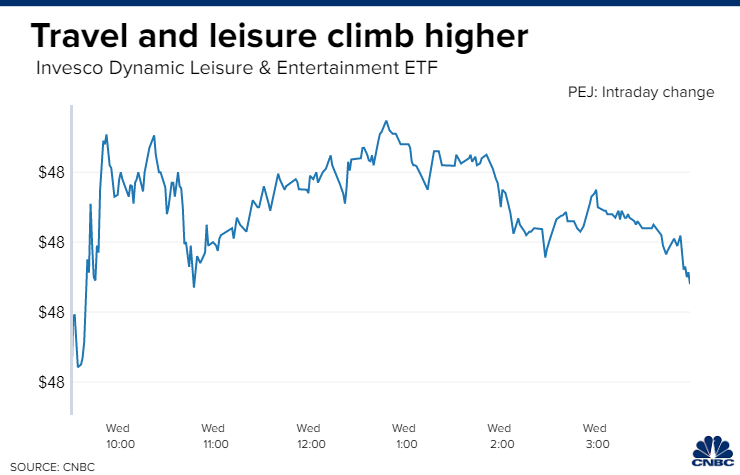

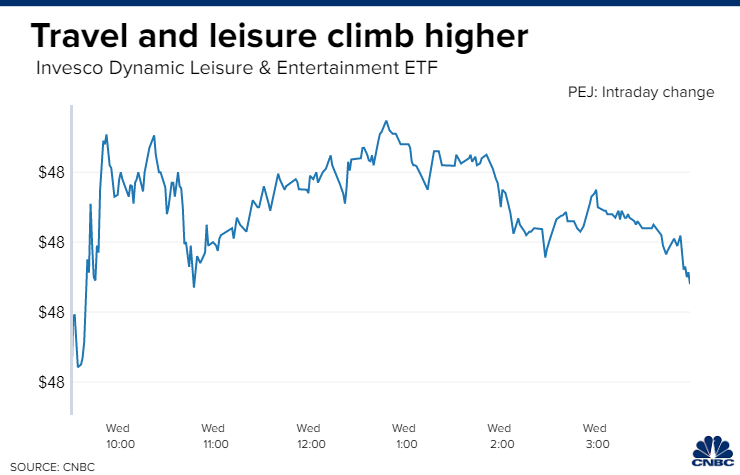

Stocks ended Wednesday's trading session slightly higher, as investors bet that the omicron variant of Covid-19 wouldn't pose a major threat to the economy. The Dow Jones Industrial Average ticked up by 0.1% in the late afternoon. The S&P 500 added 0.3% and now sits less than 1% from its record. The Nasdaq Composite gained 0.6%. Pfizer kicked off the day announcing that three doses of its vaccine are effective at neutralizing the omicron variant, citing its own preliminary lab tests. The pharmaceutical company also noted that two doses could still protect against severe disease.  Despite the positive news, trading was fairly quiet. Travel-related stocks extended their gains. Cruise and casino stocks were the biggest gainers in the S&P 500. Norwegian Cruise Line Holdings jumped 8.2% and Carnival rose 5.5%. Meanwhile, Las Vegas Sands added 4.4% and United Airlines rose 4.2%. The Invesco Dynamic Leisure & Entertainment ETF rose 1.1%. "Stocks have somewhat surprisingly, perhaps, retraced the post-Thanksgiving sell-off and decided that risk-asset valuations are not as likely to be impaired by this fourth wave of the virus (or tougher comps, or tighter monetary policy, etc.) as we thought risk assets might be only a few days ago," Goldman Sachs' Jeff Currie said in a note. |

Tidak ada komentar:

Posting Komentar