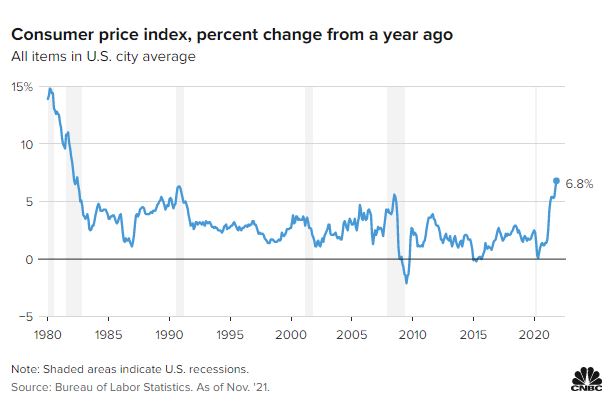

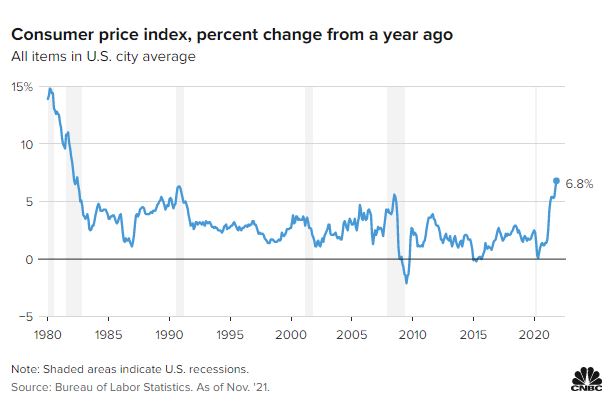

Inflation rose to its highest level in 39 years in November, but the hot print didn't spook investors.

| FRI, DEC 10, 2021 | | | | DOW | | NAME | LAST | CHG | %CHG | | AAPL | 179.45 | +4.89 | +2.80% | | MSFT | 342.54 | +9.44 | +2.83% | | INTC | 50.59 | +0.11 | +0.22% | |

| | S&P 500 | | NAME | LAST | CHG | %CHG | | F | 21.45 | +1.88 | +9.61% | | AAPL | 179.45 | +4.89 | +2.80% | | NVDA | 301.98 | -2.92 | -0.96% | |

| | NASDAQ | | NAME | LAST | CHG | %CHG | | AAPL | 179.45 | +4.89 | +2.80% | | NVDA | 301.98 | -2.92 | -0.96% | | AMD | 138.55 | +0.45 | +0.33% | |

| |

Inflation rose to its highest level in 39 years in November, but the hot print didn't spook investors. The major averages rose on Friday, with the S&P 500 notching a record close. The S&P 500 and Nasdaq Composite completed their best week since February and the Dow Jones Industrial Average had its best weekly performance since March. The consumer price index, which measures the cost of a wide-ranging basket of goods, accelerated 6.8% year-over-year, the Labor Department said Friday. This was just slightly higher than the estimate of 6.7% and looked even better than some of the expectations coming from economists at Goldman Sachs or DoubleLine's Jeffrey Gundlach. Core CPI, which excludes food and energy prices, rose 0.5% for the month and 4.9% from a year ago, in line with estimates.  Wharton finance professor Jeremy Siegel said the persistent inflation levels will push the Federal Reserve to act aggressively with its tapering and interest rate hikes in 2022. However, he said investors should stay bullish on stocks until closer to 2023.

"In the first year of the rates hikes, actually that has marked good stock markets," Siegel said Friday on CNBC's "Halftime Report." "Maybe late 2022 or 2023 [is] when you begin to get the wobbles in the stock market. Basically, the first year of increases, with the liquidity that's in the market, I think still makes a positive market for 2022."

He added that real assets, like equities, are good to hold in inflationary environments.

Stocks rebounded nicely this week from the recent omicron sell-off. The Dow Jones Industrial Average rose 4% since Monday. The S&P 500 and Nasdaq Composite added 3.8% and 3.6%, respectively, this week.

|

Tidak ada komentar:

Posting Komentar