EDITOR'S NOTE

Stocks slid to start the week Tuesday, as bond yields built on their hot start to 2022 and disappointing earnings from Goldman Sachs dented market sentiment.

The Dow Jones Industrial Average dropped more than 540 points. The S&P 500 and Nasdaq Composite fell 1.8% and 2.6%, respectively. The technology-focused Nasdaq closed at its lowest level in three months.

Goldman Sachs was the biggest drag on the Dow after losing nearly 7%. The bank missed analysts' expectations for its fourth-quarter earnings after operating expenses surged 23% on increased pay.

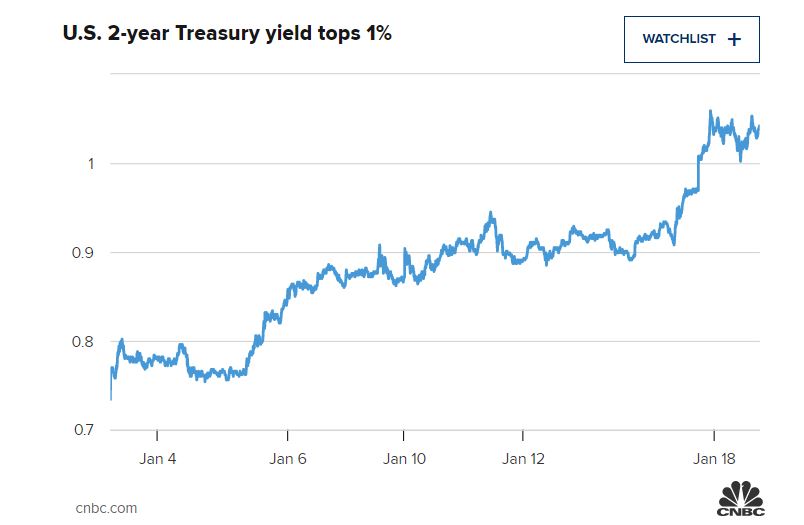

The closely watched 2-year yield broke above 1% for the first time since February 2020, triggering the decline in stocks.  "Two-year yields breaking above 1% is the bond market saying it agrees with the Fed that more aggressive hikes are coming," said Ryan Detrick of LPL Financial. "Add those worries with crude flirting with $85 a barrel and stubbornly high inflation, and we have a perfect cocktail for a risk-off day."

The 10-year Treasury yield topped 1.87% on Tuesday, its highest level since January 2020. The benchmark yield started the year around 1.5%.

Technology stocks were hit the hardest on Tuesday, spurring the Nasdaq to close below its 200-day moving average for the first time since April 2020. Growth stocks get particularly punished when rates rise as their future earnings look less attractive.

Earnings season continues on Wednesday with reports from Bank of America and Morgan Stanley before the bell.

TOP NEWS

TOP VIDEO

CNBC PRO

SPECIAL REPORTS

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Selasa, 18 Januari 2022

Stocks slump on Tuesday | Treasury yields surge | Goldman Sachs shares fall nearly 7%

Langganan:

Posting Komentar (Atom)

Tidak ada komentar:

Posting Komentar