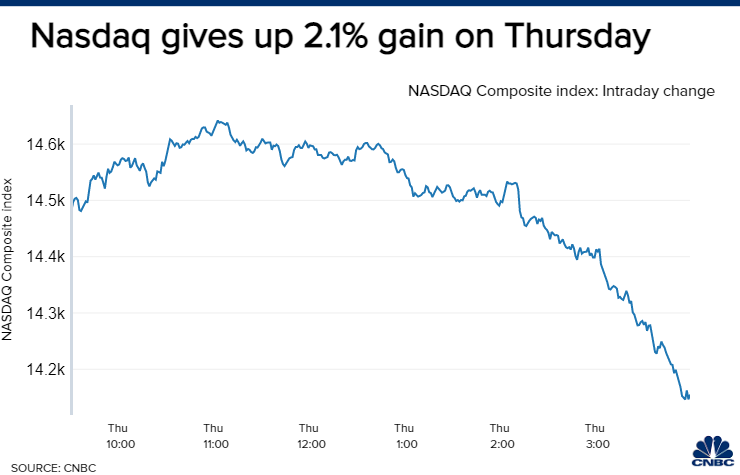

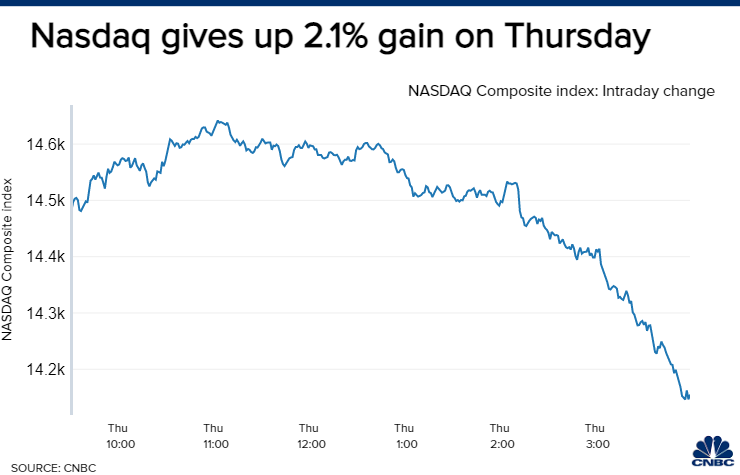

The Nasdaq Composite closed further in correction territory Thursday.

| THU, JAN 20, 2022 | | | | DOW | | NAME | LAST | CHG | %CHG | | AAPL | 164.51 | -1.72 | -1.03% | | MSFT | 301.60 | -1.73 | -0.57% | | INTC | 52.04 | -1.58 | -2.95% | |

| | S&P 500 | | NAME | LAST | CHG | %CHG | | F | 21.65 | -0.80 | -3.56% | | AMD | 121.89 | -6.38 | -4.97% | | AAPL | 164.51 | -1.72 | -1.03% | |

| | NASDAQ | | NAME | LAST | CHG | %CHG | | PTON | 24.22 | -7.62 | -23.93% | | AMD | 121.89 | -6.38 | -4.97% | | AAPL | 164.51 | -1.72 | -1.03% | |

| |

The Nasdaq Composite closed further in correction territory Thursday after failing to hold a 2.1% gain from earlier in the day. The tech-heavy index ended the session down 1.3%. The Dow Jones Industrial Average and S&P 500 followed suit. The Dow ended the day down more than 300 points, after being up by more than 400 points earlier in the trading session. The S&P 500 fell 1.1%, reversing its earlier gain of roughly 1.5%. The S&P 500 closed below 4,500 for the first time since October 2021. Investors selling in the final hour of trading has become a trend this month, according to Bespoke Investment Group.

"On average, US equities have rallied into lunch time, but there's also been heavy selling late in the session," the firm said. "Late-day declines that are much worse than average in a given month do not typically lead to underperformance going forward."

Bond yields were little changed but remained elevated on Thursday. Analysts expect the market volatility to continue due to concerns about rising rates, inflation and the economic recovery. "After a year with only one 5% correction for the S&P 500, investors need to be aware that 2022 probably will be a much rougher ride," said Ryan Detrick of LPL Financial. "With rate hikes coming and the historically volatile midterm year on the horizon, more violent ups and downs could be in store for investors this year." The S&P 500 is headed for the third straight week of losses, tumbling nearly 3.9% so far. The Dow is down 3.3% this week. The Nasdaq is the biggest loser, down by close to 5% this week. |

Tidak ada komentar:

Posting Komentar