U.S. stocks climbed to record levels and closed out Friday at their session highs as Wall Street wrapped up the week with solid gains amid rising reopening optimism.

| FRI, APR 09, 2021 | | | | DOW | | NAME | LAST | CHG | %CHG | | AAPL | 133.00 | +2.63 | +2.02% | | INTC | 68.26 | +1.21 | +1.80% | | MSFT | 255.85 | +2.60 | +1.03% | |

| | S&P 500 | | NAME | LAST | CHG | %CHG | | AAPL | 133.00 | +2.63 | +2.02% | | GE | 13.60 | +0.15 | +1.12% | | VIAC | 41.88 | -0.41 | -0.97% | |

| | NASDAQ | | NAME | LAST | CHG | %CHG | | AAPL | 133.00 | +2.63 | +2.02% | | AMD | 82.76 | -0.59 | -0.71% | | INTC | 68.26 | +1.21 | +1.80% | |

| |

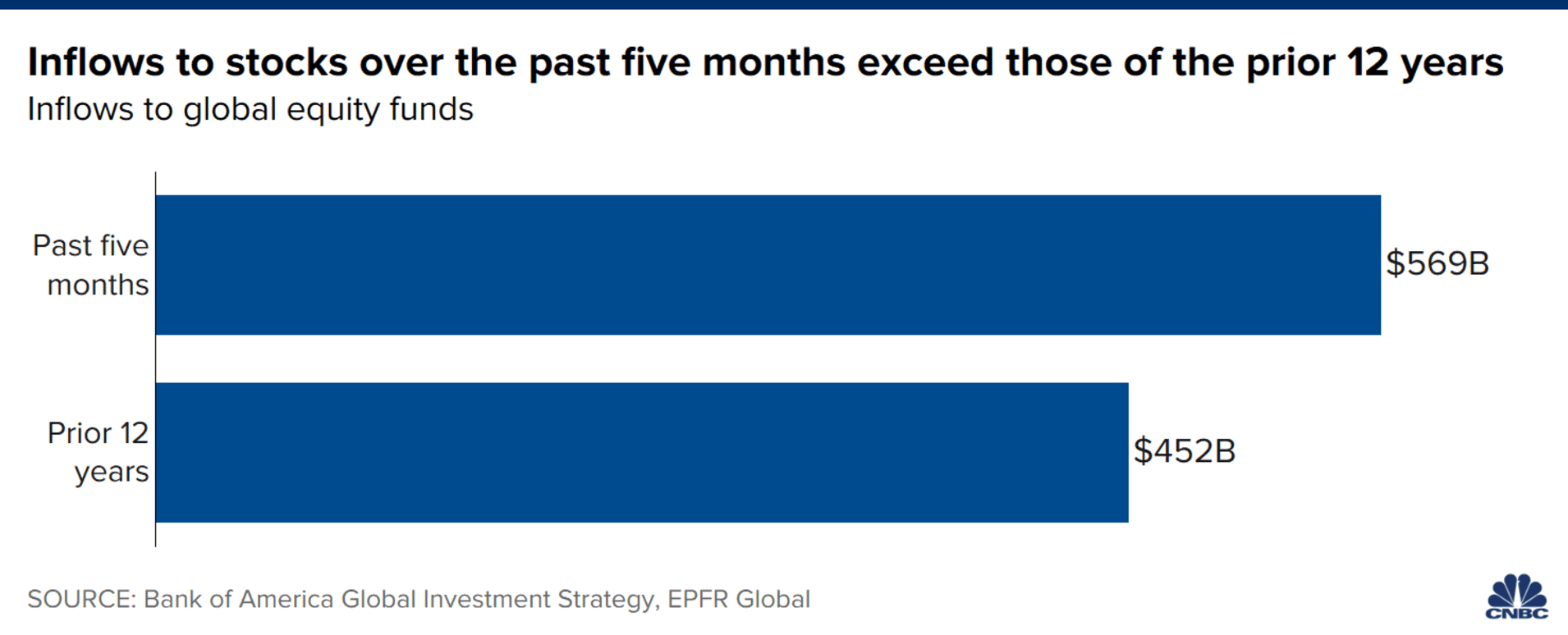

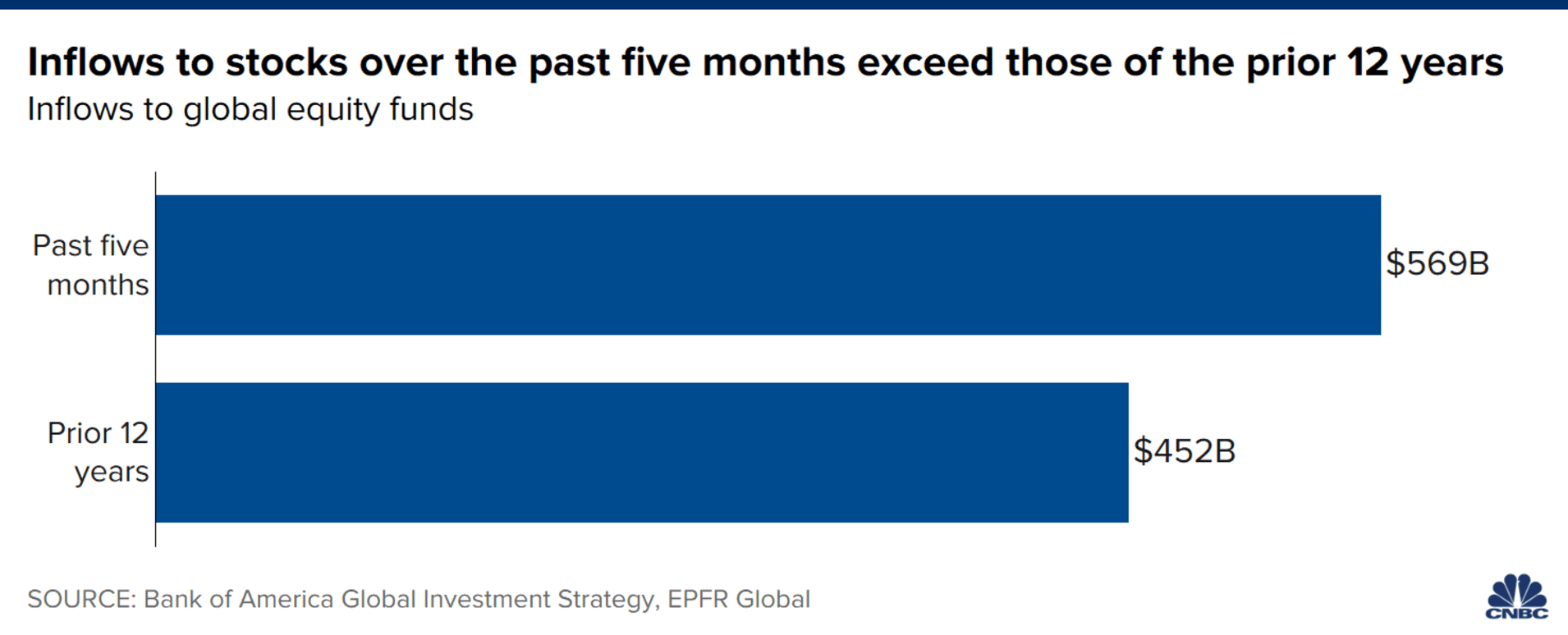

More money has gone into stock funds over the past five months than in the previous 12 years combined, a reflection on big market gains, economic enthusiasm and a rush into meme stocks. Global equity funds saw $569 billion in inflows since November, more than the $452 billion going back to the beginning of the 2009-20 bull market run, according to Bank of America. That has come amid a 26% rise in the Dow Jones Industrial Average and 40% increase in trading volume for the first quarter of 2021 compared to the final three months of 2020.  The period also has marked a run of stock speculation in highly shorted names like GameStop and AMC, along with optimism for an economy on track to post its strongest gain since 1984. "There's a certain amount of logic to markets right now," said Art Hogan, chief market strategist at National Securities. "It's less about irrational exuberance in the overall market, less about the 1999-2000 levels, and more about what's the driver. The driver is clearly an explosion in economic activity that likely will have some earnings growth in its wake." Investors next week will get a look at key earnings and inflation numbers that will help determine whether the rush to stocks will continue. |

Tidak ada komentar:

Posting Komentar